Hong Kong News

US lawmakers slam SEC head over crypto crackdown, driving firms to China

A Republican lawmaker has slammed US Securities and Exchange Commission (SEC) Chair Gary Gensler over policies that the congressman said are sending crypto firms to China and “into the hands” of the Communist Party, in a searing rebuke on the House floor that comes as Hong Kong courts overseas crypto firms in a bid to become a virtual asset hub.

“Your regulatory style lacks flexibility and nuance, and as a result, you’ve been an incompetent cop on the beat, doing nothing in protecting everyday Americans and pushing American firms into the hands of the CCP,” congressman Tom Emmer, a House representative from Minnesota, told Gensler during a Financial Services Committee hearing on Tuesday.

Emmer is one of four co-chairs on the Congressional Blockchain Caucus and one of the body’s biggest crypto advocates, saying the US needs to pursue policies that ensure crypto reflects “American values of privacy, individual sovereignty, and free market competitiveness”.

He is also one of the biggest beneficiaries of financial contributions from the crypto industry. During the 2022 election season, he was the fifth-largest recipient of contributions from crypto companies, pulling in US$90,516, according to figures compiled by Open Secrets.

A slew of enforcement moves by the SEC have recently drawn anger, with US crypto firms arguing that it is not clear to the industry which blockchain tokens the regulator considers securities or which platforms could be targeted.

In recent weeks, the SEC has sued multiple exchanges including Binance, the world’s largest cryptocurrency exchange, along with its founder Zhao Changpeng. Tron’s Justin Sun was sued for fraud.

The SEC also looks to be readying action against Coinbase, the largest crypto exchange in the US, as the company said it received a Wells notice about potential enforcement action from the regulatory agency.

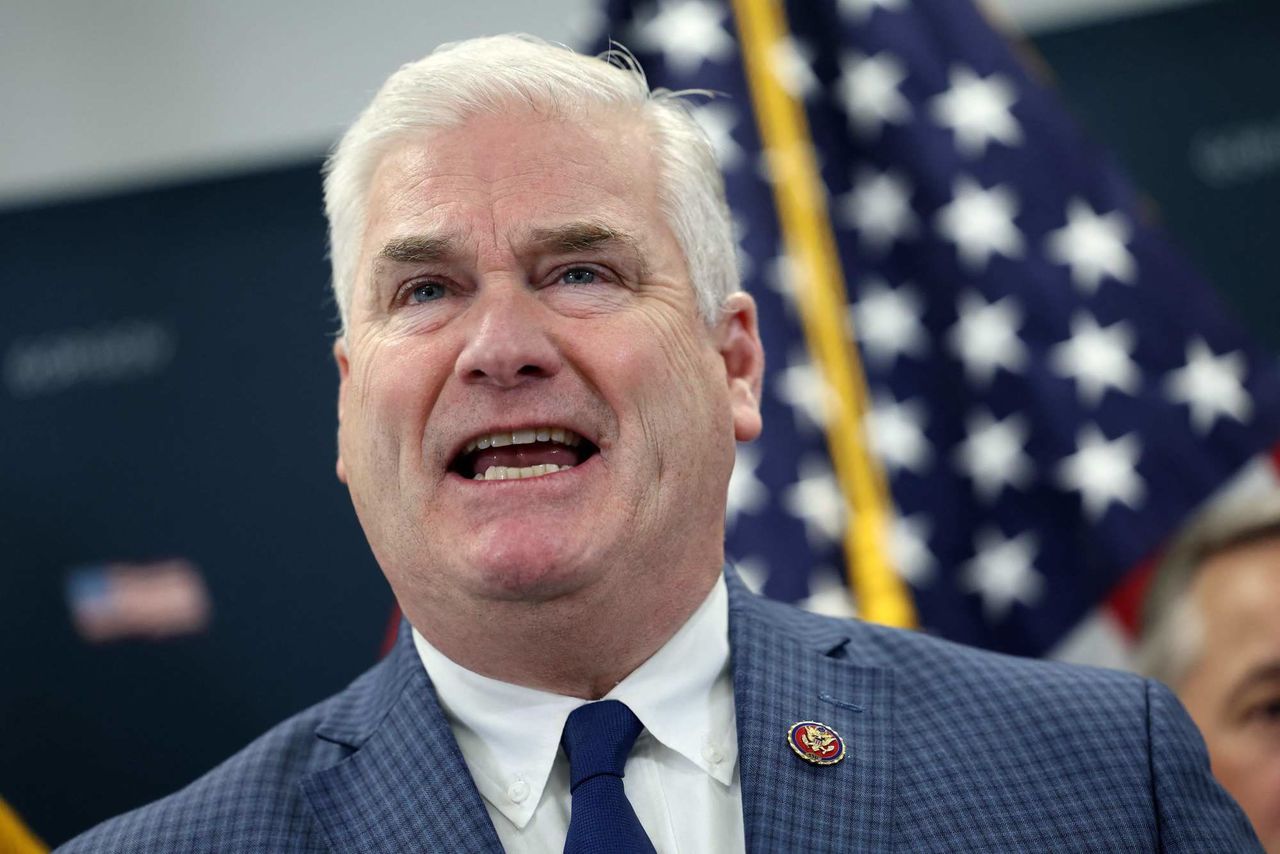

US House Majority Whip Tom Emmer speaks at a press conference following a

House Republican meeting at the Capitol on March 28 in Washington.

US House Majority Whip Tom Emmer speaks at a press conference following a

House Republican meeting at the Capitol on March 28 in Washington.

Mainland China maintains a strict ban on cryptocurrencies, opening the door for Hong Kong to become the country’s digital asset hub under the “one country, two systems” arrangement.

Some exchanges with ties to China that left the country during previous crackdowns are now eyeing expansion in Hong Kong. Huobi and OKX said they will apply for licenses to serve retail investors in the city later this year, as will be required under new regulations starting from June.

Hong Kong’s crypto firms have for years had difficulties accessing local banking services, but more banks in the city have recently started to take on crypto clients.

Mainland Chinese officials also for the first time publicly endorsed Hong Kong’s moves, with senior directors at the Cyberspace Administration of China (CAC) and the Liaison Office of the Central People’s Government in Hong Kong praising the city’s efforts during appearances at local tech conferences last week.

During Tuesday’s hearing, a number of other Republican lawmakers also grilled Gensler about his regulatory moves against crypto, calling his approach “nonsensical” and “regulation by enforcement”. Gensler defended his approach, saying the industry was rife with noncompliance and that he believed there was enough clarity in securities rules for crypto firms to comply.

Lizzy Fallon, financial services policy adviser to Emmer, in January suggested that Gensler was in for a tough year of questioning from Congress.

“2023 is the year for oversight,” Fallon said during a CES panel in Las Vegas titled “Make America #1 in Blockchain and Financial Innovation”. “It’s the year we’re going to flex our subpoena power, and it’s the year that Gary Gensler should get a cot because he’s going to be in Congress a lot.”

During the event, Fallon echoed Emmer’s sentiments about “American values”. She said Congress was working to ensure that “crypto opportunities stay on shore for Americans”, as she had heard from firms that it was hard for them to hire in the US.

Fallon also contested the idea that the US is falling behind on blockchain because China has a large-scale trial of a central bank digital currency. In China, this technology reflects the “opposite philosophy” to the US, she said. Some have criticised the digital yuan as having the potential to give the Chinese government even greater insight into citizens’ finances and spending.

“Falling behind China on crypto technology would be falling behind China on developing a surveillance state,” she said. “So I completely disagree with the idea that we’re falling behind China in this space at all.”