Hong Kong News

The Real Recession Is Just Starting

At month’s end, we are going to see the BLS announce a 30%+ bounce in real GDP (the Atlanta Fed’s forecast is now above 35%). Much of this is already priced into the equity market, so a positive or negative reaction will only occur if the reported number is significantly above or below the consensus view. In addition, this is old news, as Q3 will have been in the rear-view mirror for a month.

Markets worried about a change in Fed policy which tolerates higher inflation rates, and that, along with some rebound in depressed commodity prices and some food (supply related) and used car price increases caused interest rates to move up slightly in late September. Underlying inflation is non-existent, and rents, a major component of the Consumer Price Index (CPI) are falling. Furthermore, true to its word, the Fed expanded its balance sheet in mid-October to push the yield curve lower.

The best gauge of economic health is employment, and, on that front, the news is not good. New unemployment claims continue at well over +1.2 million/week; the pre-virus norm is +200K. When all claims are considered, the total is more than 25 million, a real unemployment rate in excess of 15%.

Stimulus’ Impact on Spending

On Friday (10/16), the news that retail sales rose 1.9% in September buoyed the equity markets early on after several losing sessions during the week as hopes for an immediate additional fiscal stimulus package faded.

In a recent blog I explained how consumption rose in August, even as incomes fell, due to the large pool of savings resulting from the CARES Act. There was still a small amount of savings left in that pool over and above what was the pre-virus norm as measured by the St. Louis Fed. I suspect that last of those “excess” savings were spent in September, causing that unexpected rise in retail spending.

But, even with the unexpectedly good retail sales news (up 1.5% even ex-autos – used car sales are on fire as the public eschews public transit), the markets finished flattish on the day and down for the week. Despite all of the hoopla around the data releases, without the stimulus, the economy would have contracted (by at least -10% according to economist David Rosenberg).

Even with the headline retail sales, the underlying economy is truly in Recession and will be there for a significant period of time. An economy not in Recession doesn’t need a Fed pumping up its balance sheet and the money supply. (The Fed added $75 billion to its balance sheet the week ended Wednesday, October 14th; no wonder rates retreated across the yield curve!) An economy not in Recession also doesn’t need another fiscal stimulus package that the Fed (Powell in particular) is begging for. While that appears to be stalled for political reasons, it likely will proceed after November 3rd.

The Interest Rate Scene

Interest rates rose over the past month triggered in part, by the Fed’s policy shift in the way inflation will impact monetary policy going forward, in part, by the FOMC minutes (Federal Open Market Committee, the rate making Fed committee), which openly worried that more fiscal stimulus was needed but would not be forthcoming in a timely manner (and subsequently Chairman Powell’s promise to Congress that the Fed would monetize any fiscal deficits (his “hand in hand” comment)), and, in part, due to the expectation that any new stimulus would arrive post-election no matter who won (but a larger stimulus if the Democrats win). Because a new stimulus would dramatically increase supply, rates began to drift up in late September/early October. True to its word, the Fed provided the loot to push rates back down over the last several market sessions.

And Inflation

There has also been some concern about the re-emergence of inflation, another factor causing the recent mild spike in interest rates. That concern was initially stoked by the change in how the Fed will target future inflation. We have seen some spikes in the prices of commodities and food. Many of the commodity spikes were simply a bounce back from large downdrafts last spring. The price spikes in food, especially meat, is largely due to supply issues as processing plants dealt with virus prevention issues. The headline PPI (Producer Price Index) for September was +0.4%. Ex-food and energy, however, it was a very meek +0.1%. So, no inflation to worry about at the manufacturing level. September’s CPI (Consumer Price Index) rose +0.2% versus August and +0.2% ex-food and energy. Year over year, CPI is up 1.37%; again not displaying any worrisome tendencies. Rent and rent equivalent calculations (related to mortgage costs) comprise more than a third of the CPI Index. Rents are now deflating, especially in densely packed urban centers, and falling mortgage rates have an impact on the mortgage calculations in the index. So, it appears that measured CPI inflation isn’t going to be a problem for quite some time, at least until after we get through the coming wave of evictions.

Unemployment, the Real Economic Indicator

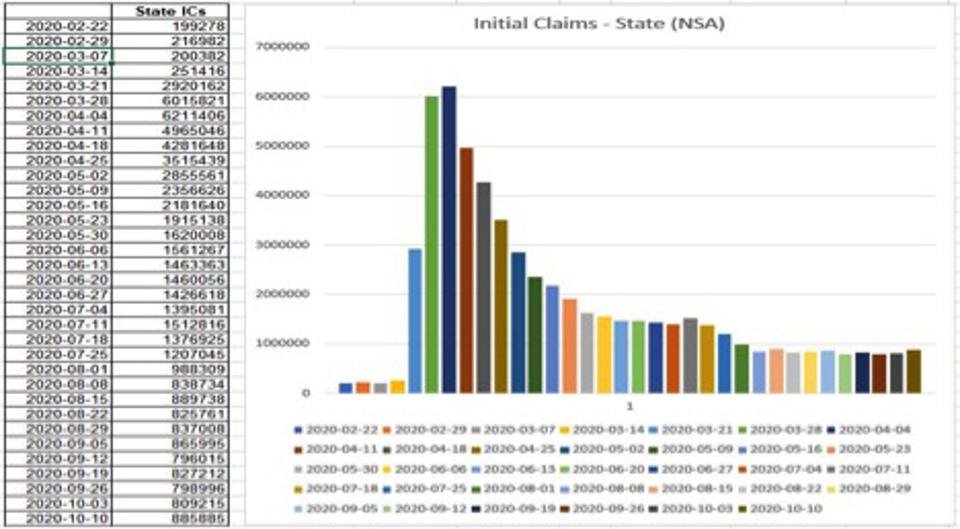

To gauge the health of the economy, one needs to look no further than the state of the labor market. And, on that front, the news is not good. At the state level, Initial Claims (ICs) jumped more than +76K in the first full measurement week of October and this is without any reporting from California. (The California IC data for the week of September 26th has been used in the October 8th and October 15th data releases covering the weeks ending October 3rd and October 10th. California is due back on-line for the data release on October 22nd, covering the week ending October 17th. Likely there will be significant upward revisions. Unless California found and fettered out a significant number of fraudulent claims, the Disney and airline layoffs probably swelled their IC numbers – we will know soon!

The accompanying table and chart of state ICs shows the flat to slightly rising right-hand tail. “Normal,” i.e., pre-virus, is shown in the left-hand tail. Let’s also remember that +885K ICs are new layoffs, most of which occurred in the prior week. Yikes! In addition, ICs under the CARES Act PUA program (Pandemic Unemployment Assistance – for self-employed, independent contractors, and gig workers) added another +373K. While the PUA ICs fell -91K from the prior week’s +464K level, when the state ICs and PUA ICs are added together, the result is a mind-blowing +1.26 million ICs for the week of October 10th. That’s 6.5 months after the initial shock.

Initial Claims- State (NSA) Universal Value Advisors

When the Continuing Claims (CCs) are added to the ICs as shown in the

chart and table at the top of this blog, there remain more than 25

million unemployed. While the “official” U3 number is 7.9% for

September, the “real” unemployment rate is in the 15%-20% range. The

right-hand side of the chart shows that, while total unemployment is

down from its 32 million peak in June, the improvement halted in

September. The left-hand tail of the chart shows the much, much lower

pre-virus norm.

Finally, much of the fall in CCs in the state

programs appear to be an exhaustion of eligibility, not re-employment.

The monthly BLS JOLTS (Job Openings and Labor Turnover Survey) report

shows declining hiring and the various surveys from employment

consultants show continuing significant levels of new layoffs.

Conclusions

* Don’t be fooled by the retail sales data or the talk of the return of inflation;

* Don’t hold your breath for or hold out cash in anticipation of rising interest rates;

* The economy is in Recession; we just haven’t felt it because of the

CARES Act stimulus, but, eventually we will because we have a huge, huge

unemployment problem;

* And then there is the oncoming eviction

crisis (on hold until year’s end); there hasn’t been much discussion

about this, and I wonder if it is priced into financial markets;

* The CARES Act stimulus has covered up the Recession, and another

stimulus, post-election, may further kick the can down the road, but

free cash cannot go on forever without dire consequences;

* The Recession will persist as long as the virus persists (and we seem to be entering into a second, resurgent phase). A vaccine would help, but getting enough people to take it (providing herd immunity) and then returning to pre-virus behavior may take years, not quarters.

Comments