Hong Kong News

Rival or partner? Shenzhen eclipses Hong Kong, Tokyo as stock trading jumps

Shenzhen turned 40 last month as a special economic zone. Fashioning itself after Silicon Valley, the mainland Chinese city is home to some of the world’s biggest companies such as Huawei Technology, Tencent Holdings and Ping An Insurance.

Its financial sector has more to celebrate as the Shenzhen Stock Exchange approaches 30 in December. Some 670 billion yuan (US$98.9 billion) worth of stocks change hands on average every day this year, making it the busiest bourse in Asia.

Since its inception in December 1990, some 2,339 companies have raised US$93.4 billion from initial public offerings (IPOs), according to Refinitiv. ChiNext, its board of start-ups, has been on a tear as its capitalisation surged to a third of Shenzhen exchange’s total.

With Hong Kong’s future clouded by political and economic crises, is the mainland city north of the border a worthy rival? Or does its future lie as a partner in the biggest scheme of things?

“The two exchanges are competitors if you look at listings as a zero-sum game,” said Anthony Neoh, an adviser to the Shenzhen Stock Exchange on its strategic development. “However, there is much differentiation in the two markets because the Hong Kong market is not encumbered at all by currency restrictions and has a more friendly tax regime for investors.”

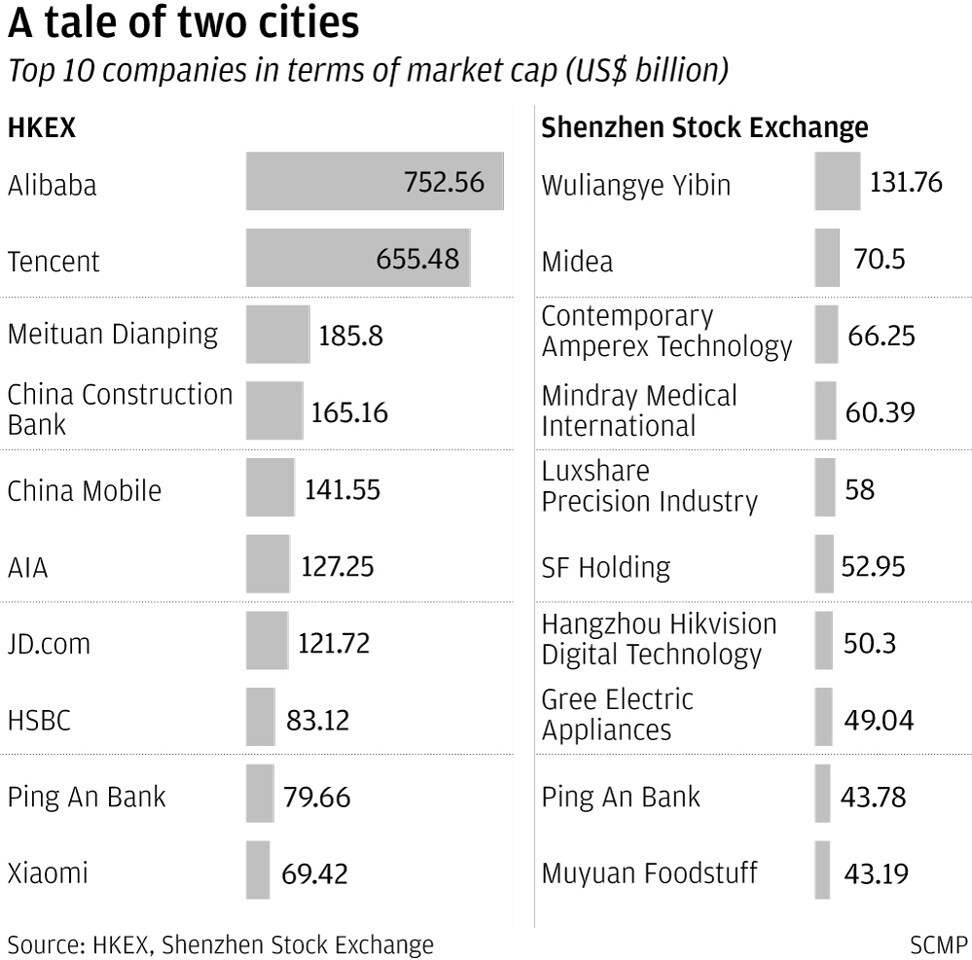

Shenzhen’s stock market turnover is about five to six times higher than the value of shares that changed hands in Tokyo, Seoul or Hong Kong, and about 30 per cent higher than in Shanghai. Its biggest company is Wuliangye Yibin, whose namesake baijiu made from five organic grains is the tonic behind its 890 billion yuan market value.

In ChiNext, Shenzhen has a venue for its deep pool of start-ups. More than 860 companies have raised US$70 billion since its formation in 2009. In contrast, Hong Kong’s GEM board for growth and emerging companies only accounted for 0.3 per cent of its US$5.3 trillion capitalisation, despite having a 10-year head start.

“When I went to Shenzhen in 1994 to help companies there to raise funds from international markets, the only choice was Hong Kong,” Clement Chan, managing director of accounting firm BDO. On the flip side, foreign investors did not know much yet about Shenzhen.”

Today, Shenzhen is the richest among nine cities in southern Guangdong province, which together with Hong Kong and Macau, make up a US$1.65 trillion economic cluster under China’s Greater Bay Area initiative.

Despite its credentials, Shenzhen still lacks scale, BDO’s Chan said. Its champion Wuliangye Yibin trails in size to those traded in Hong Kong, such as Alibaba Group Holding, Tencent, and Meituan Dianping. They have raised US$516 billion in IPO proceeds since 1990, about 5.5 times more than Shenzhen-listed firms, according to Refinitiv.

The impending IPO of Ant Group, China’s largest digital payments provider whose impending IPO is expected to be the world’s largest ever, is listing in Shanghai and Hong Kong. The gap between Shenzhen and Hong Kong will only widen when that happens.

“Hong Kong stock market plays host to the larger companies which have grown beyond mere start-ups,” said Neoh, who was a former chief adviser of China Securities Regulatory Commission from 1998 to 2004. “Shenzhen has been willing to take on smaller brownfield companies.”

Shenzhen and Hong Kong have about 4,700 listed companies with a combined market value of about US$10 trillion. The sum of the parts may be larger than the individual strength of each market, adviser Neoh said.

“HKEX and Shenzhen Stock Exchange are still leading markets for Chinese businesses,” said Stephen Chan, a partner at law firm Dechert. “Therefore, we would expect both to continue to benefit from the growth of China’s economy in the long run.”

As China’s economic recovery gains traction, the agenda looks promising. It syncs with some of the aims in Hong Kong Exchanges and Clearing (HKEX)’s strategic plan, to support portfolio diversification by mainland investors.

Shenzhen last month outlined a 50-point blueprint to expand and upgrade its financial services sector to grease trade and capital flows with investors based in Hong Kong and elsewhere, according to a report published by Shanghai Securities News. The plan includes 85 measures to strengthen market cooperation.

“This cooperation is supported by the currency restrictions in place,” Neoh said. “I cannot see the People‘s Bank of China opening up the capital account in full for at least the next 10 to 15 years and although there will be some liberalisation.”