Hong Kong News

Hong Kong Stages Impressive Intra-Day Rally

The Hang Seng Index opened down -0.91%, sank to an intra-day low of -1.85% before staging an impressive comeback to close +0.67%. The Hang Seng rebound was without support from Mainland investors as Southbound Connect was closed in advance of Friday’s market holiday.

Troubled property developer Evergrande sold its stake in Shengjing Bank for RMB 10B/$1.55B leading to a rally in both Hong Kong financials and real estate companies. Hong Kong internet stocks were off today after yesterday’s strong rally.

The Cyberspace Administration issued a notice on the use of internet algorithms that I found difficult to understand. It appears to limit internet companies from using algos to push products or make recommendations. Hard to say if this was a factor in today’s weakness. Worth noting that Mainland media highlighted 14th Five Year Plan’s emphasis on the importance of e-commerce development.

Energy, materials, and utility stocks were hit hard by energy shortages in both the Hong Kong and China markets. Mainland markets were weak as there were only 526 advancing stocks versus 3,650 declining stocks in a true risk-off day. The Mainland closes for Golden Week on Friday until next Friday as investors are apt to take chips off of the table in advance of the week-long holiday. Similar to Hong Kong, real estate and financials were a little less worse off than the broader market as consumer staples was the only positive sector.

The PBOC replaced RMB 60B of expiring reverse repos with RMB 100B to support liquidity in advance of the holiday. There was a fair amount of chatter on ramping up coal production to address coal shortages and less emphasized by the media, that strong demand for electricity is outstripping supply driven by the Chinese and global economy coming back online. Gree Electric Appliances gained +3.12% on news they are canceling shares bought back, which should help earnings per share. Foreign investors were net sellers of Mainland stocks by a small amount.

Last night I had the privilege of speaking at the Hartford CFA Society. On the way home I listened to Bloomberg Radio’s coverage of Asian markets. They happened to interview an EM manager who was hesitant on China but all in on India. Underweight China and overweight India is fairly typical positioning from global and EM managers at the moment. The great Hong Kong-based host Bryan Curtis noted that India’s benchmark is trading at a P/E ratio of 30 versus Hang Seng’s P/E of 10. I would have added that India is a significant importer of commodities which could be a headwind for the economy.

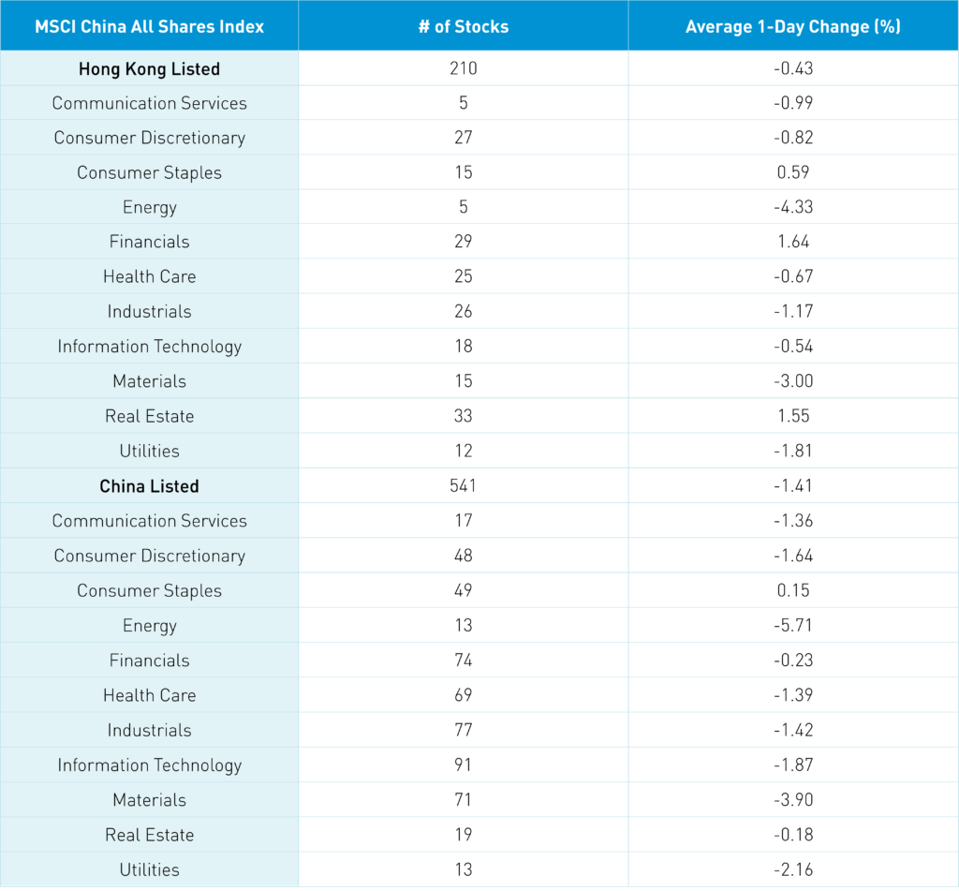

MSCI China All Shares Index

MSCI China All Shares Index

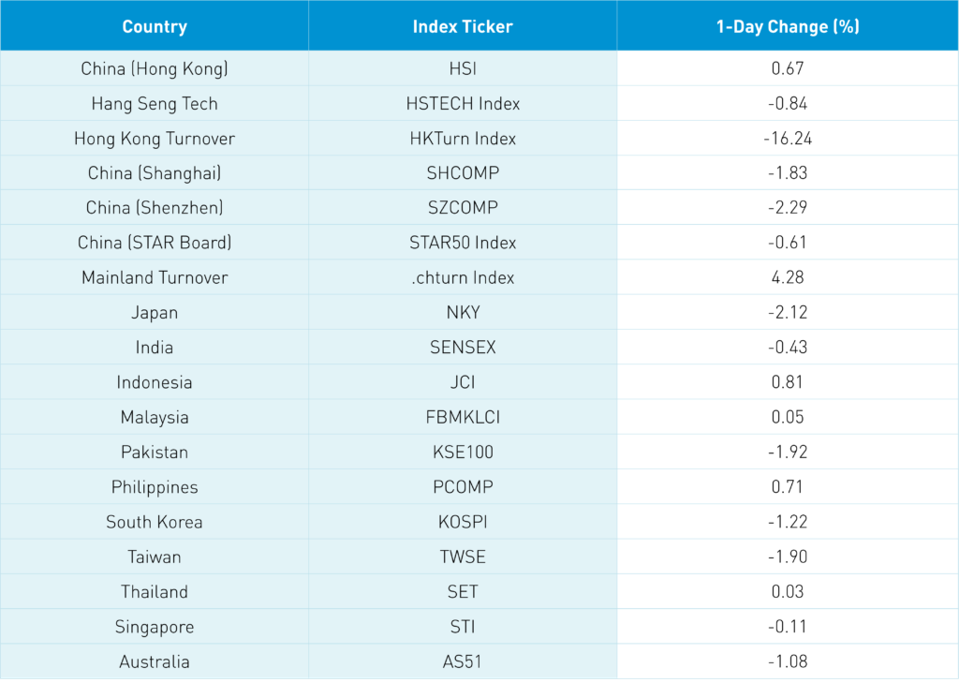

Country performance

Country performance

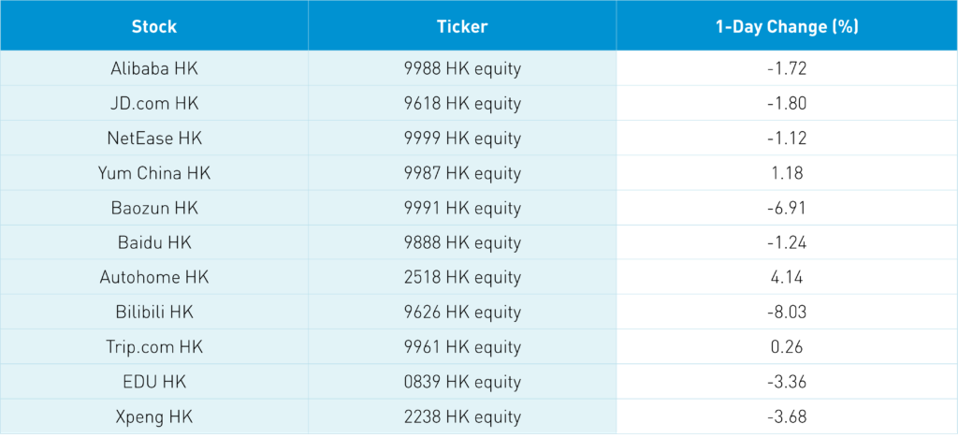

Stock performance

Stock performance

H-Share Update

The Hang Seng opened -0.91%, hit an intra-day low of -1.85% before rallying to close +0.67% on volume -16.24% from yesterday which is 72% of the 1-year average. The 210 Chinese companies listed in Hong Kong within the MSCI China All Shares lost -0.43% with financials +1.65%, real estate +1.55% and staples +0.59% while energy -4.33%, materials -3%, utilities -1.81% and industrials -1.17%. Hong Kong’s most heavily traded by value were Tencent -1.02%, Alibaba HK -1.72%, Meituan -0.71%, AIA +3.07%, China Construction Bank +2.96%, Wuxi Biologics +0.16%, Ping -1%, China Merchants Bank +3.57%, JD.com HK -1.8% and Li Ning +1.44%. Southbound Stock Connect was closed today.

A-Share Update

Shanghai, Shenzhen and STAR Board were off -1.83%, -2.29% and -0.61% on volume +4.28% from yesterday which is 110% of the 1-year average. The 541 Mainland stocks within the MSCI China All Shares lost -1.41% with staples +0.16% while energy -5.71%, materials -3.9%, utilities -2.15%, tech -1.86%, discretionary -1.63%, industrials -1.41% and healthcare -1.38%. The Mainland’s most heavily traded by value were Tianqi Lithium +1.11%, Kweichow Moutai -0.11%, CECEP Sol Energy -1.6%, COSCO Shipping -9.07%, Wuliangye Yibin +0.8%, China Three Gorges Renewables -5.36%, China Northern Rare Earth -6.37%, Luzhou Laojia -0.72%, BYD -4.4% and Gangfeng Lithium -4.21%. Northbound Stock Connect volume were moderate as foreign investors sold -$41mm of Mainland stocks today.

Last Night’s Exchange Rates, Prices, & Yields

* CNY/USD 6.47 versus 6.46 yesterday

* CNY/EUR 7.54 versus 7.55 yesterday

* Yield on 10-Year Government Bond 2.86% versus 2.88% yesterday

* Yield on 10-Year China Development Bank Bond 3.19% versus 3.21% yesterday

* Copper Price -0.87% overnight

Krane Funds Advisors, LLC is the investment manager for KraneShares ETFs. Our suite of China focused ETFs provide investors with solutions to capture China’s importance as an essential element of a well-designed investment portfolio. We strive to provide innovative, first to market strategies that have been developed based on our strong partnerships and our deep knowledge of investing. We help investors stay up to date on global market trends and aim to provide meaningful diversification. Krane Funds Advisors, LLC is majority owned by China International Capital Corporation (CICC).