Hong Kong News

Hong Kong can deepen engagement with Indonesia, Asean’s largest economy

As Hong Kong reopens, we must seize the moment for meaningful re-internationalisation and the 10-member Asean bloc, our second-largest trading partner, is a linchpin.

Within the Association of Southeast Asian Nations, Indonesia is the largest economy. It is the world’s 10th-largest economy in purchasing power parity terms and poised to become the fourth-largest by 2045; Indonesia’s strategic importance is only increasing. The International Monetary Fund expects its economy to grow by 5 per cent this year, close to China’s 5.2 per cent projection.

It makes good sense for Indonesia and Hong Kong to have a constructive and symbiotic relationship. Both are known for their open embrace of multilateralism, internationalisation and global friendships, rooted in their rich, diverse and agile cultures; both thrive on connectivity in trade, innovation and tourism.

Hong Kong must improve its knowledge, understanding, language proficiency and engagement with this core pillar of Asia’s future. Indeed, there are four areas where action is needed.

First, Hong Kong, as a global financial centre and China’s most international city, should leverage its financial and legal institutions to advance Indonesia’s public and developmental interests. We can continue to be an international finance centre for Asia in the 21st century provided we cater to the needs of both China and the Asean economies, including Indonesia.

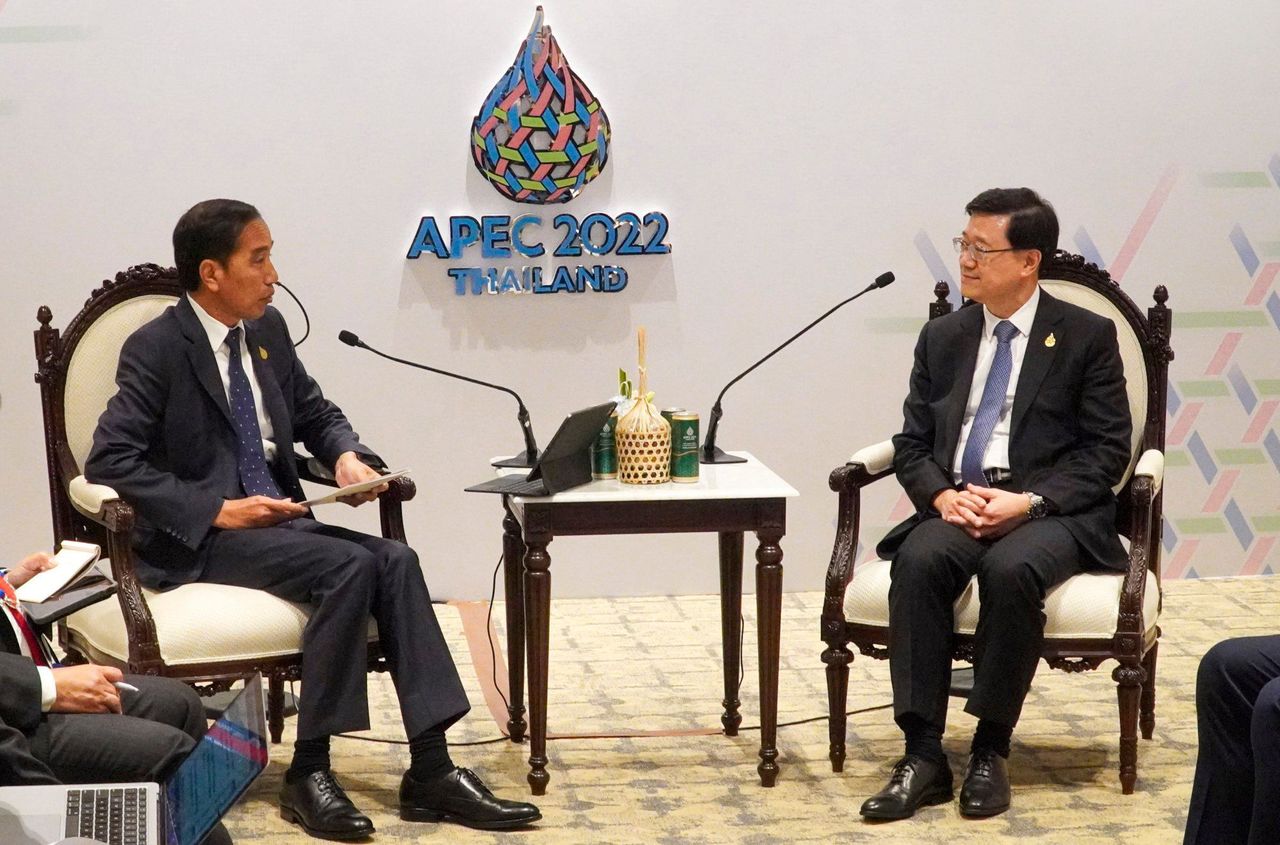

Indonesian President Joko Widodo meets Hong Kong leader John Lee Ka-chiu

at the Asia-Pacific Economic Cooperation (Apec) forum in Bangkok on

November 18, on Lee’s second day of his debut overseas trip aimed at

relaunching the financial hub at a high-level regional summit.

Indonesian President Joko Widodo meets Hong Kong leader John Lee Ka-chiu

at the Asia-Pacific Economic Cooperation (Apec) forum in Bangkok on

November 18, on Lee’s second day of his debut overseas trip aimed at

relaunching the financial hub at a high-level regional summit.

A few immediate steps include scaling up the outreach of our sukuk programme (for the sharia-compliant bond-like instrument) to cultivate a larger financial workforce sensitive to Islamic cultural traditions and needs, and offering a gateway into China for high-net-worth individuals and family offices from Indonesia.

Through these measures, we can establish ourselves as the premier engine and source of capital for Indonesian infrastructure projects and long-term undertakings. This is crucial with the imminent relocation of the capital to Borneo, which has enormous potential.

Hong Kong’s renewed emphasis on supporting start-ups is most welcome, and should be expanded to include our friends in Indonesia. Hong Kong stands to gain from nurturing the rapidly growing venture capital and innovation scene in Jakarta. The pairing of our investors and funds with Indonesian entrepreneurs and tech talent will benefit both sides.

Second, Hong Kong must position itself as the premier “trade 2.0 hub” between Northeast and Southeast Asia, bolstering our capacities and making forays into nascent areas of high-end professional services, including blockchain-based trade technology and financing, and also digital operations, insurance, and legal arbitration and mediation. The Making Indonesia 4.0 strategy provides the perfect road map for Hong Kong’s post-manufacturing service providers to explore collaboration with their Indonesian counterparts.

Such efforts are crucial in building the goodwill and institutional wherewithal to boost trade between China and Asean. We need to attract Indonesian companies by offering our unrivalled access to the Greater Bay Area – this could include reduced barriers to entry, one-stop and tailored services for administrative affairs and tax concessions for companies to establish their Northeast Asian headquarters in Hong Kong.

The chambers of commerce have an essential role to play. We must also listen to a wider range of stakeholders invested in Hong Kong-Indonesian relations. It is time to ramp up our engagement with key provincial and municipal players, as well as private investors and entrepreneurs.

Third, Hong Kong needs to step up the spearheading of green and environmental, social and corporate governance (ESG) financing for decarbonisation and the renewable energy transition throughout Asia. Indonesia is a prime partner. Its nickel mines account for 37 per cent of global output, giving it a substantial advantage in the electric vehicle (EV) industry as nickel is a key component of car batteries.

Joint efforts among institutes producing cutting-edge research in mainland China, private equity and investors in Hong Kong, and manufacturers in Indonesia could yield a sustainable and mutually advantageous EV ecosystem.

Our financial industry is a pioneer when it comes to green finance and ESG disclosure requirements. Research into how to improve supply-chain compliance with carbon emissions requirements could point the way for Indonesian regulators and companies as they move away from non-renewable energy sources. Indeed, the quintessential “Hong Kong story” is our ability to draw out the very best in others.

Finally, Hong Kong and Indonesia must commit to expanding our cultural, tourism and academic ties. Hong Kong’s world-class infrastructure makes it an ideal host for a wide range of events and exhibitions, as well as dialogues and conversations over Asia’s future.

Hong Kong needs to more effectively promote our unique, eclectic blend of Western, Southeast Asian and Chinese cultures. We must enhance our capabilities as a site for cultural exchange and aspire to improve ties to triangulate the Hong Kong-Indonesian relationship, to complement the comprehensive strategic partnership between China and Indonesia.

Our tourism industry leaders and regulators must also work with their counterparts in Indonesia to reduce barriers to entry, and strengthen mutual awareness and understanding. From Borneo’s lush greenery to Bali’s breathtaking architecture, there is much to love and do in Indonesia. We can take a leaf from them about how to incorporate cultural and heritage preservation into our tourism.

At the core of all international partnerships lies the ability of individuals to work with one another. The future of our friendship has never been brighter.