Hong Kong News

Evergrande: End of the road for developer as US$37 billion bill looms?

China Evergrande Group, the world’s most indebted property developer, is facing a final notice after engaging in a years-long spending spree to construct a sprawling empire spanning everything from theme parks to electric vehicles(EVs).

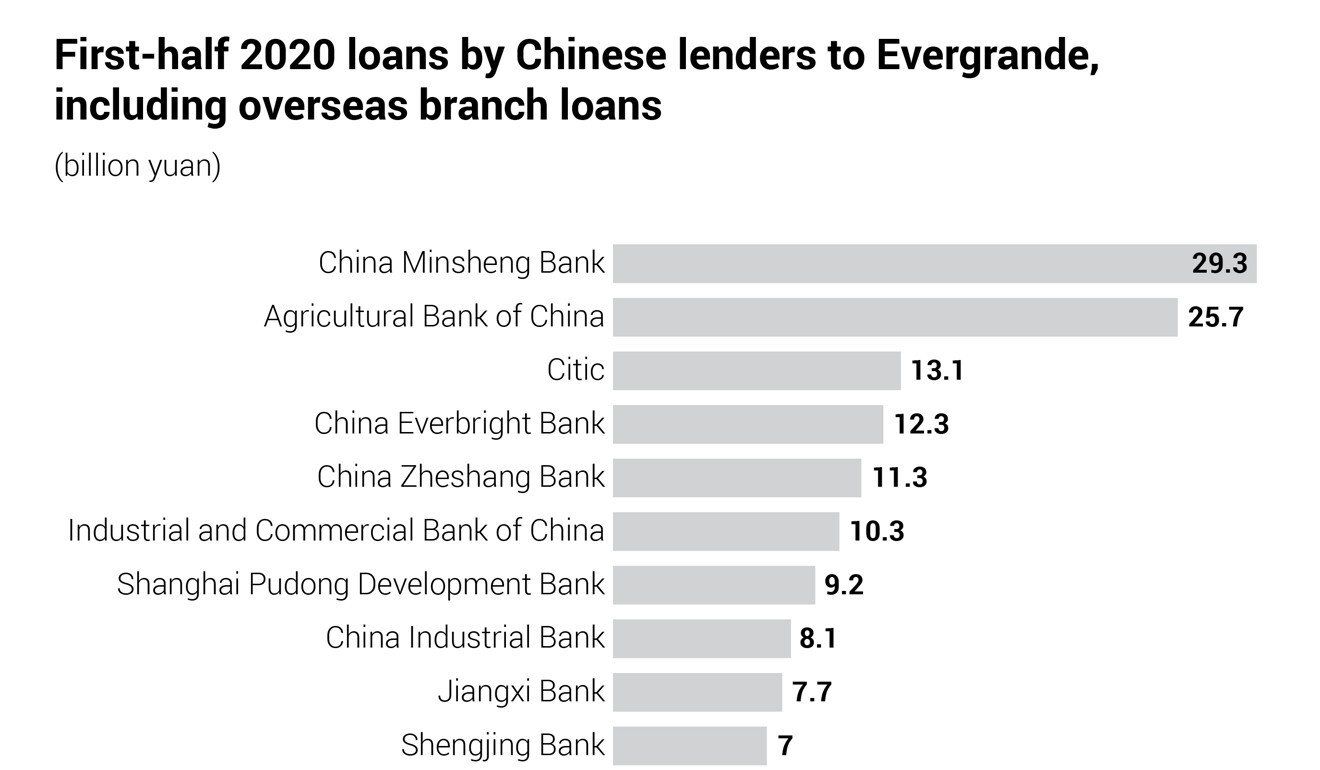

The Shenzhen-based company, which at one point unsuccessfully employed martial-arts star Jackie Chan as a pitchman for its mineral water brand, tapped the bond markets nearly 40 times in a four-year period and amassed hundreds of billions of yuan in bank loans as it sought to expand its core residential housing business and diversify the scope of its operations – even as its total liabilities exceeded US$300 billion.

But, the bill for that largesse is coming due, as fears are rising about its ability to repay its cascading pile of debt against the backdrop of muted property sales in mainland China and efforts by Beijing to rein in the property sector in the past year.

The developer’s property portfolio had 144 billion yuan (US$22.3 billion) worth of completed apartments, houses, commercial and retail spaces ready for sale as of June 30. But Evergrande faces a mountain of short-term borrowings, from bank loans to offshore bonds, totalling about 240 billion yuan, due by the end of June in 2022.

That means, even without considering any expenses for marketing or human resources, Evergrande would not have enough finished property projects in its entire portfolio to generate the cash that can meet its financial obligations. It may need to dig into the family treasures within its 2.7 trillion yuan of total assets. Potential avenues for capital raising it could tap to avoid going under include its HK$29.5 billion (US$3.8 billion) Hong Kong-listed EV unit, its stake in China’s most valuable football club – and even founder Hui Ka-yan’s US$60 million superyacht.

The company’s short-term debt load – it has US$1.1 billion in interest payments alone due on its corporate bonds and senior notes between now and January – is nearly as much as the 259 billion yuan in combined borrowings owed in the next 12 months by its three closest competitors: Country Garden, China Vanke and Sunac China Holdings.

It also has US$13.2 billion in onshore and offshore bonds that are set to reach maturity within the next three years as part of another 332 billion yuan in outstanding long-term liabilities. That compares with just 86.8 billion yuan in unrestricted cash on its balance sheet as of June 30.

“I would not trust a company that owes so many people so much money,” said Joyce Huang, a house-hunter in Shenzhen. “I don’t believe it can deliver a home on time and, even if it can, it might be of poor quality and difficult to sell when I want to resell it.”

Huang almost signed a contract for an Evergrande project in Shenzhen’s Longhua district in August, only to be delayed in doing so while waiting for money to be transferred from her parents. “I felt that I dodged a bullet,” she added.

The question roiling financial markets – the latest in a series of China-related hits this summer – and prospective buyers is whether the biggest home seller by sales in China can sell enough homes in the near term to avoid a collapse.

In addition to its portfolio of completed homes, Evergrande had a stable of properties under development worth 1.3 trillion yuan as of June 30, according to its interim report.

At least a third of these homes under development have been pre-sold, but it may be difficult to sell the rest to generate cash because of the uncertainty surrounding Evergrande’s future, according to CGS-CIMB Securities’ Raymond Cheng.

“It has to offload its assets – lands in particular – to keep the last hope of continuing paying on time,” Cheng said. “It can only sell the completed homes now to collect money, with large discounts.”

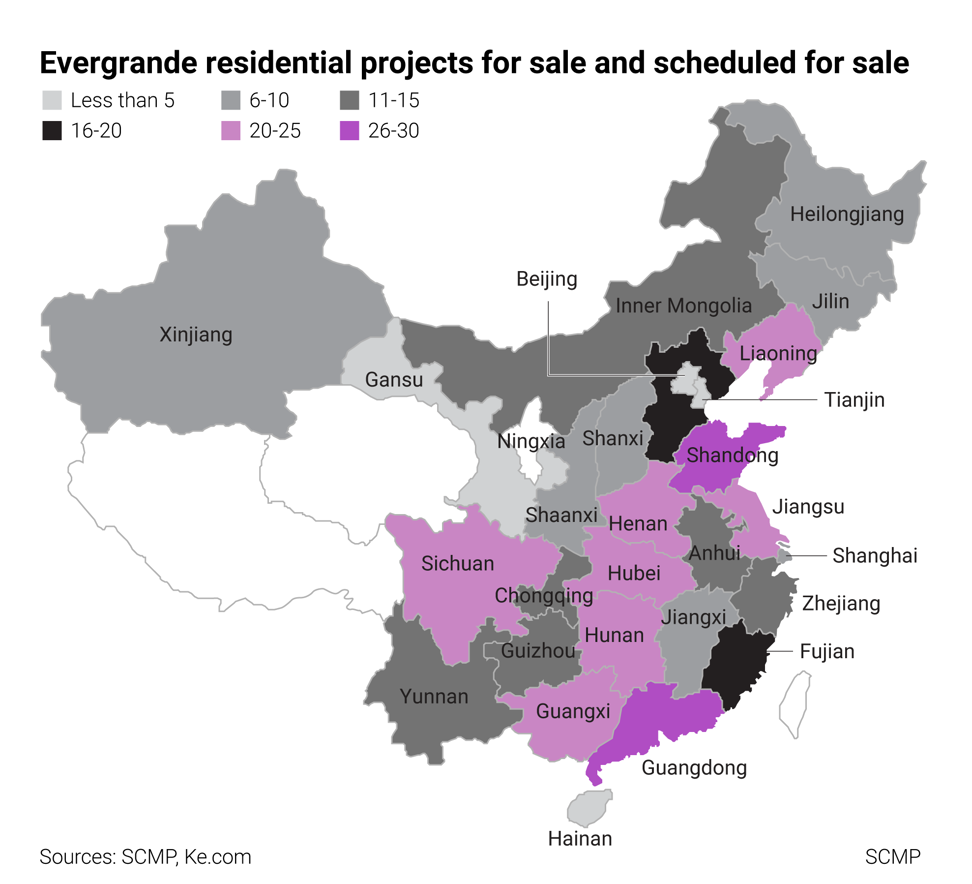

Evergrande had land reserves covering 214 million square metres (2.3 billion sq ft) of gross floor area related to 778 projects as of June 30. These reserves were originally valued at 456.8 billion yuan, the company said.

However, most of the money collected from any potential land or home sales is expected to go towards completing the construction of other properties it has pre-sold but not yet finished, Cheng added.

In addition to its efforts to ramp up home sales, the company has been offloading assets this summer to pay IOUs it owes to its suppliers and contractors, in hopes of giving itself a potential financial lifeline by completing more unfinished properties. On Wednesday, Evergrande sold a 19.93 per cent stake in Shengjing Bank worth US$1.55 billion, to settle existing liabilities with the lender.

Evergrande chairman Hui Ka-yan speaking at the fifth meeting of the 12th session of the CPPCC National Committee in 2017.

Evergrande chairman Hui Ka-yan speaking at the fifth meeting of the 12th session of the CPPCC National Committee in 2017.

The Evergrande crisis has already caused borrowing costs to soar for China’s property sector and the developer has turned to restructuring experts

who worked on implosions at Lehman Brothers, Luckin Coffee and commodity trader Noble Group to help it shed debt.

“One of the key issues that caused Evergrande’s distress is essentially their capital structure. Compared to other developers, Evergrande has relied more on short-term debt, in terms of the debt [and] in terms of the borrowings. Not only that, they have also relied heavily on trade payables,” said Adrian Cheng, co-head of China properties at Fitch Ratings. “When things go haywire and liquidity dries up, you basically get into a very difficult situation.”

Evergrande did not respond to requests for comment.

Founded in Guangzhou by Hui Ka-yan in 1996, Evergrande rode the wave of private ownership of property in China, building affordable high-rise flats for the mass market. The company went public in Hong Kong in 2009 and grew to be China’s biggest property developer by sales, employing more than 163,000 people as of the end of June.

It expanded into the food and drink business, only to sell its “fast consuming” products business for a combined 2.7 billion yuan in 2016, a few years after employing action star Chan as a spokesman for its spring water brand. (Some online commentators in China have recently attributed Evergrande’s problems to the “Jackie Chan curse”, as several brands he has promoted in the past have fallen on bad luck.)

As part of its efforts to alleviate its cash crunch this summer, the company sold its remaining 49 per cent interest in the bottled water business, Evergrande Spring Group, for 2 billion yuan after mulling a potential initial public offering to raise cash this summer.

In addition to its core property business, its operations include an EV maker that has yet to produce a car, a theme park operator that plans to open indoor-only outlets focused on Chinese culture in 15 cities, an online streaming platform, a wealth management business and a 50 per cent ownership in Guangzhou Evergrande FC, China’s richest football team. The other half of the football team is owned by the Post’s parent, Alibaba Group Holding.

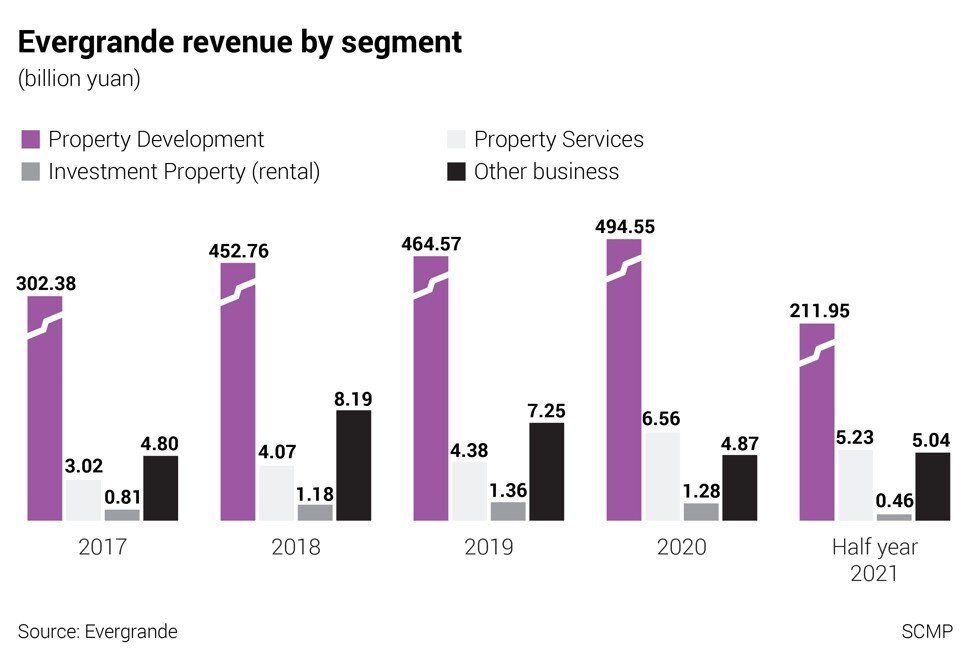

Despite its efforts to diversify, these businesses accounted for less than 1 per cent of its revenue in 2020, or about 5 billion yuan. The company generated 98 per cent of its revenue from the sale of properties, with rental income and property management services accounting for the rest of its turnover last year. As Evergrande offered steep discounts to drive sales in the first half of the year, the contribution of its non-property businesses rose to about 2 per cent of its revenue.

The developer’s biggest hope to avert a collapse lies in its ability to rapidly sell its existing property portfolio.

It undertook 65 new projects for sale in the first half of the year and Hui, Evergrande’s chairman, said in March that the developer would sell 750 billion yuan worth of properties this year. As of June 30, it had 1,236 projects for sale, including completed properties and flats under construction.

Jackie Chan in a scene from ‘Kung Fu Yoga’. Chan was once a pitchman for Evergrande’s mineral water brand.

Jackie Chan in a scene from ‘Kung Fu Yoga’. Chan was once a pitchman for Evergrande’s mineral water brand.

However, Evergrande’s moneymaking machine is losing its lustre as concerns about its future – following multiple downgrades by major credit rating agencies – have discouraged prospective buyers and investors.

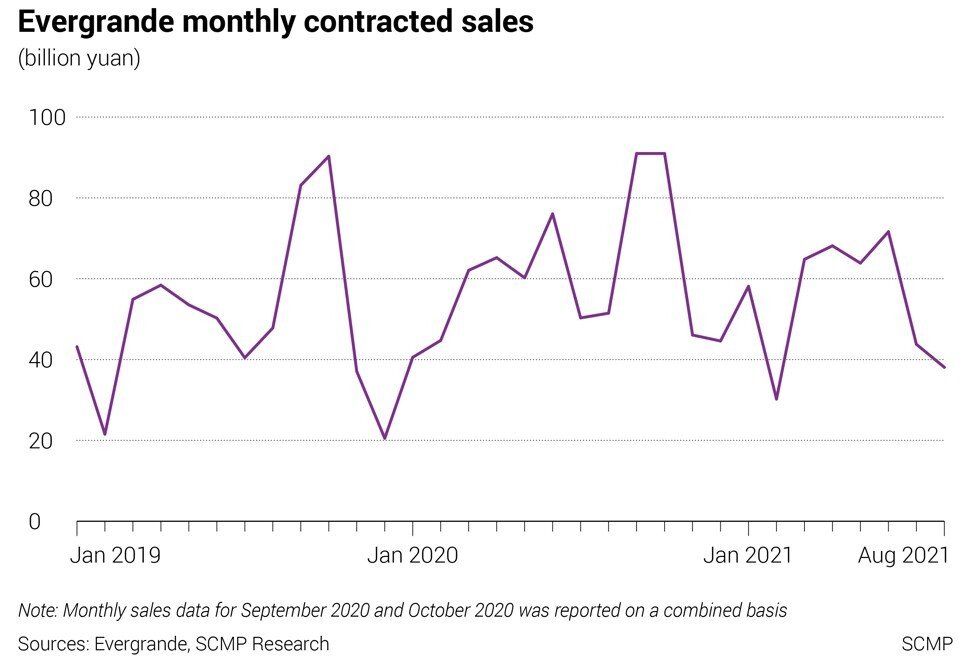

Its contracted sales, which are driven primarily by presales, fell in July and in August, with the company recording its worst August in five years amid sales of just 38.08 billion yuan. So far this year, it has fetched 438.64 billion yuan in contracted sales, well below Hui’s target.

The sales environment was “tough” this year as regulators tightened their control on the sector, but Evergrande was still able to lure buyers with sharp discounts in the first half, according to Wang Bin, an agent in Huizhou.

“It was bad, but not dead. After those protest videos went viral online, I would be scolded by my clients if I introduced Evergrande projects to them,” Wang said. “The company might not fall yet, but its reputation is bankrupt already.”

Protesters streamed into Evergrande’s head office in Shenzhen on September 11 to demand refunds on wealth management products offered by the company, with videos of protesters shouting “Give me back my hard-earned money” going viral.

Citing negative media coverage, the company further warned two weeks ago that it expected a “significant continuing decline” in contracted sales in September.

The spiralling debt levels at Evergrande come against the backdrop of a go-go housing market in a country with one of the highest home ownership rates globally. More than 90 per cent of households in China own their homes and more than 20 per cent of families own multiple properties.

The speculative nature of the housing market in the world’s second-largest economy has been a difficult one for Chinese officials to tamp down: home ownership is considered a necessary step for young couples to get married and multiple generations of families often live together as parents age.

In August 2020, the People’s Bank of China, the country’s central bank, adopted its “three red lines” requirements, which limited the amount developers could borrow, as part of its ongoing efforts to slow these speculative bubbles.

For Evergrande and other developers, this made it more difficult to use bank loans to cover liquidity needs between the time they start building a property and the time they sell a flat.

Evergrande, for example, has only tapped the bond markets five times since Beijing’s three red lines decree, borrowing a total of 14.3 billion yuan through onshore corporate bonds and US$424 million through offshore senior notes.

The company also redeemed early US$1.6 billion in two-year senior notes in October last year and redeemed early another HK$18 billion (US$2.3 billion) in convertible bonds between November 2020 and February of this year to further reduce its debt load.

In a bid to meet its obligations to its lenders, debt holders and other creditors, Evergrande has been tapping into its property portfolio and selling other assets.

Between the end of June and August 27, the company sold properties to suppliers and contractors to offset about 25.2 billion yuan in outstanding payments. It also sold stakes in Hengten Networks Group, Shengjing Bank, the aforementioned bottled water business and other assets and projects for a combined 14.3 billion yuan.

It also said in September that it was actively exploring the sale of its office building in Wan Chai, as well as potential sales of part of its interests in its EV and property services units. Last week, the company said it would no longer pursue plans to list Evergrande New Energy Vehicle Group, its EV business, on the Star Market, Shanghai’s Nasdaq-style board.

However, these asset sales – and potential sales – represent a drop in the bucket compared to the liabilities that the company has coming due by next June.

The company has US$1.6 billion in coupon payments on its offshore debt and another 2.9 billion yuan on its onshore debt that are set to be made between now and June 30, 2022. It also has an additional US$3.5 billion in debt that is set to mature by next April.

It remains unclear if Evergrande made a coupon payment of US$83.5 million on offshore debt due on September 23, or a separate payment of US$45.2 million on another bond due this past Wednesday. The deadlines passed without a statement from the company and the bondscould be declared in default if it does not make payments within a 30-day grace period.

In downgrading Evergrande, Fitch said on Wednesday that it was “likely” that the home builder missed the September 23 payment on a US$2.03 billion bond, which reaches maturity in March.

Meanwhile, a handful of local governments in China have also asked the developer to put cash from presales of its properties into government-controlled custodial accounts to protect the interests of flat buyers, the Financial Times reported this week. That could further restrict Evergrande’s ability to repay its obligations on time.

“Evergrande is heading for restructuring”, with Beijing likely to intervene, TS Lombard analysts Rory Green and Andrea Cicione said in a September 24 research note. The company “is no longer a viable business”.