Hong Kong News

China Internet Companies Move To Comply With Regulations & Rebound

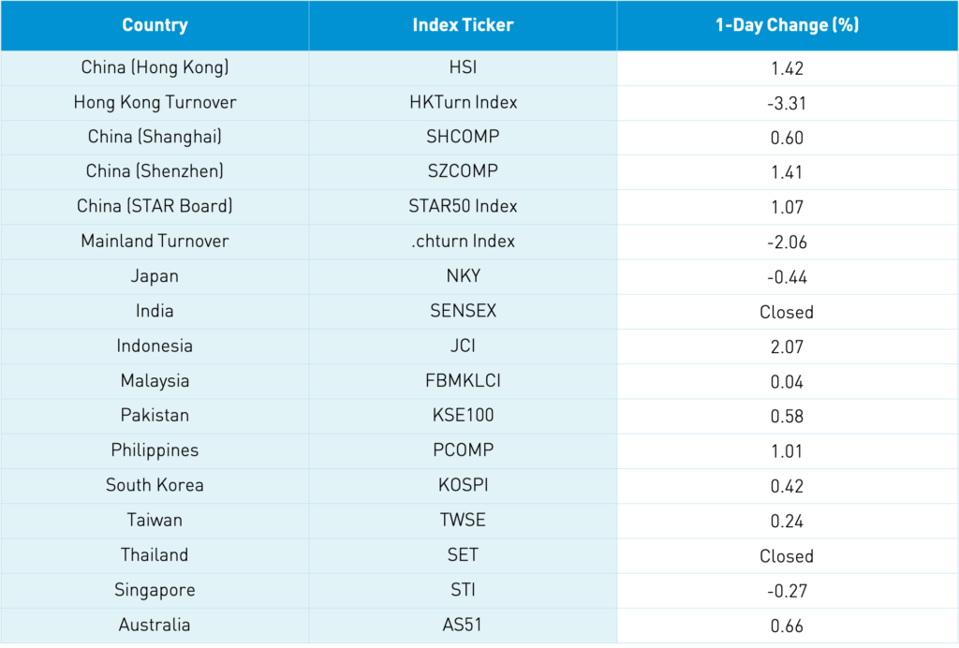

Asian equities had a strong day on light volumes except for Japan, which was off a touch. Meanwhile, Thailand and India were on holiday.

We ended yesterday in the US with rumors that the Archegos saga is not quite over. Credit Suisse CS +0.1% was reportedly selling shares of Discovery and IQ. However, the rumored block trades were not priced significantly below the stocks close giving hope this fiasco is closer to the end.

Several Chinese internet companies responded to yesterday’s meeting and statement from the State Administration for Market Regulation that they would move quickly to comply with regulations within the one-month grace period. Evelyn Cheng of CNBC had a good article on the subject.

Meituan denied rumors it had sold shares after its share price fell yesterday. There was some chatter this morning that Bytedance, which is known for its US app TikTok, might be going public in Hong Kong, though I have not seen any filings for the company. Tencent’s We Doctor is likely getting closer to its IPO.

Reuters had a good article on Premier Li’s appeal for more US-China dialogue during a meeting with US companies in China. This follows the US sending diplomats to Taiwan yesterday, to which China responded with a big flyover. Yesterday, I participated in an event that included speakers on the US political stance regarding China. The tone was dismal as the US stance appears keen on slowing China’s economic growth. The analogy I came up with is the US is playing Tonya Harding to China’s Nancy Kerrigan. If you cannot beat them on the ice, take a metal bar to their knee. I could not help but think what a terrible strategy that would be, especially as far as the global economy is concerned. Shouldn’t we figure out a way to prosper along with China? Even a very negative speaker admitted China’s economy is already larger than US, assuming purchasing power parity. It is also important to remember how well US companies are doing in China despite all the political rhetoric.

The US Chamber of Commerce put out a piece that attempted to quantify the potential impact of a decoupling between the US and China. According to the report, the US would take a $500 billion GDP hit and the most affected sectors would be US aviation, which would see a loss of $38B to $51B annually, US semiconductors, which would see $54 to $124B in lost output and 100,000 in lost jobs, US chemical industry, which would see $38B in output losses and 100,000 in lost jobs, and the US medical device industry, which would see $23.6B in annual revenue lost, totaling $479B within the decade. As such, there appears to be a massive disconnect between business leaders and politicians regarding China positioning.

Index Performance

Index Performance

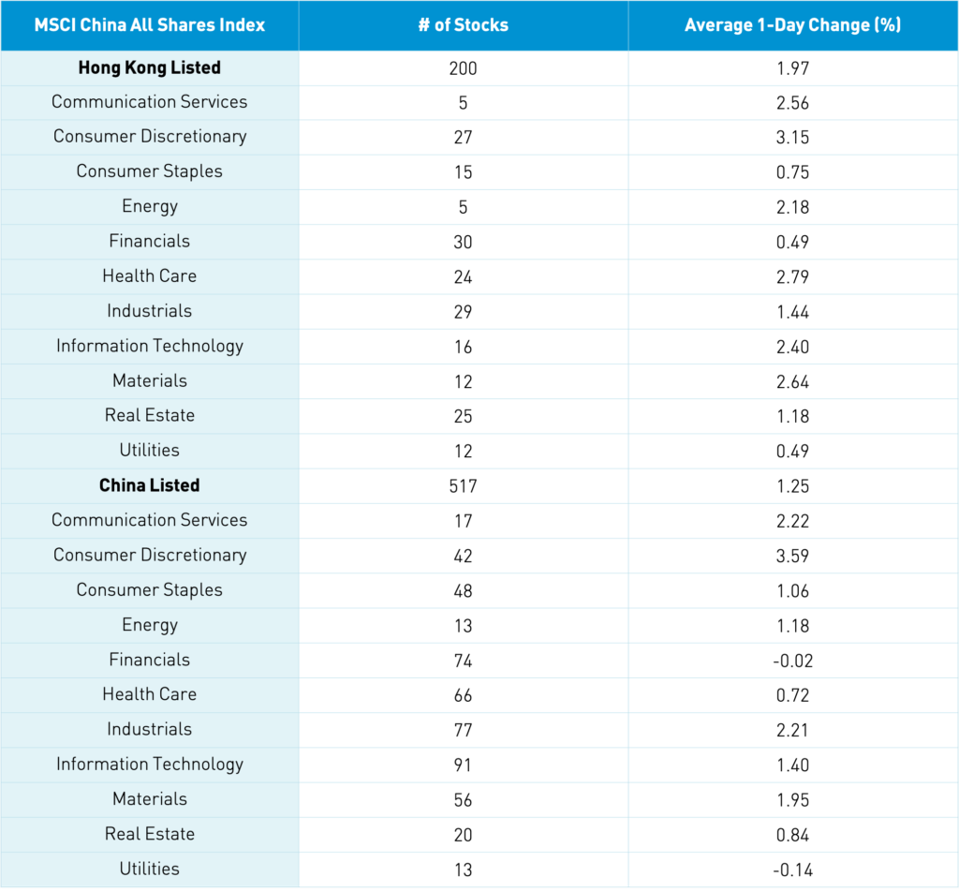

Sector Performance

Sector Performance

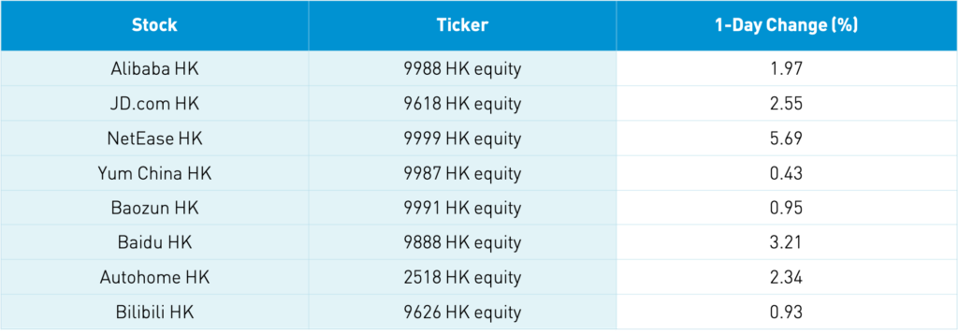

Stock Performance

Stock Performance

H-Share Update

Hong Kong had a strong day led by internet companies and growth stocks as the Hang Seng gained +1.42% while the Chinese companies within the MSCI MSCI -0.6% China All Shares Index gained +1.97%. In sector moves, consumer discretionary stocks gained +3.16%, healthcare gained +2.79%, materials gained +2.65%, communication gained +2.57%, and tech gained +2.4%. Volume was off -3% from yesterday, which is just 87% of the one-year average. Hong Kong’s most heavily traded stocks by value were Tencent, which gained +2.55%, Meituan, which gained +3.62%, Alibaba HK, which gained +1.97%, Xiaomi, which gained +2.01%, BYD, which gained +5.94%, China Mobile, which was flat, Ping An Insurance, which gained +0.77%, Geely Auto, which gained +4.99%, AIA, which fell -0.4%, and JD.com HK, which gained +2.55%. Southbound Stock Connect volumes were the lightest we have seen in a long time as Mainland investors bought a measly $167 million worth of Hong Kong stocks as Southbound Connect trading accounted for 10% of Hong Kong turnover.

A-Share Update

Shanghai, Shenzhen, and the STAR Board gained +0.6%, +1.41%, and +1.07%, respectively, as growth names and favored sectors (cleantech, electric vehicles, and healthcare) rose. Volumes were off -2% from yesterday, which is just 74% of the one-year average. Meanwhile, breadth was strong with 2,956 advancers and 913 decliners. The 517 Mainland stocks within the MSCI China All Shares Index gained +1.27% led by discretionary, which gained +3.62%, communication, which gained +2.24%, industrials, which gained +2.24%, and materials, which gained +1.87%. The Mainland’s most heavily traded stocks by value were BOE Tech, which gained +7.35%, white horse name Jiangsu Hengrui Medicine, which fell -3.89% leading to a lot of mainland chatter on the drop after fellow white horse name SF Express EXPR +4.8% fell last week, China Tourism, which gained +8.41% after its fall yesterday on earnings, CATL, which gained +6.54%, broker East Money, which gained +4.96%, BYD, which gained +4.23%, Kweichow Moutai, which gained +1.29%, TCL Tech, which gained +3.4%, Ganfeng Lithium, which gained +9.27%, and Longi Green Energy, which gained +0.65%. Gree Electric Appliances gained +1.27% today, though it posted a preliminary Q1 net income forecast between +106% to +144% so tomorrow should be a good day for the stock. Foreign investors bought $877 million worth of Mainland stocks today as Northbound Connect trading accounted for 6.2% of Mainland turnover. CNY had a big move versus the US dollar while bonds were off a touch and copper managed a small gain.

Last Night’s Exchange Rates, Prices, & Yields

* CNY/USD 6.53 versus 6.54 yesterday

* CNY/EUR 7.81 versus 7.81 yesterday

* Yield on 1-Day Government Bond 1.58% versus 1.54% yesterday

* Yield on 10-Year Government Bond 3.17% versus 3.16% yesterday

* Yield on 10-Year China Development Bank Bond 3.57% versus 3.57% yesterday

* China’s Copper Price +0.47% overnight

About KraneShares

Krane Funds Advisors, LLC is the investment manager for KraneShares ETFs. Our suite of China focused ETFs provide investors with solutions to capture China’s importance as an essential element of a well-designed investment portfolio. We strive to provide innovative, first to market strategies that have been developed based on our strong partnerships and our deep knowledge of investing. We help investors stay up to date on global market trends and aim to provide meaningful diversification. Krane Funds Advisors, LLC is majority owned by China International Capital Corporation (CICC).