Hong Kong News

Ant Group’s IPO wins swift approval from Shanghai’s Star Market

Ant Group, China’s largest digital payments provider by volume, received the green light on Friday to proceed with its blockbuster listing on Shanghai’s Nasdaq-style stock market just four weeks after filing, as regulators showed off their keenness to pull out all stops to help national champions raise capital.

With the nod, the paperwork for Ant Group’s estimated US$30 billion initial public offer (IPO) – the largest in global financial records – will pass to the China Securities Regulatory Commission for registration before it begins a process of marketing the shares to investors, and for setting a price, most likely in October.

Ant Group’s separate application for a dual listing in Hong Kong is still wending its way through the listing committee of the city’s stock exchange, where a hearing for the IPO is likely to be scheduled some time this month, according to a source familiar with the matter. The stark contrast between the two exchanges underscores how Shanghai’s Star Market could balloon into a 2.8 trillion yuan (US$400 billion) financial market after a mere 12 months in operation, and eight months to conceive.

“It’s a huge positive,” said Wayne Shiong, a partner at venture capital firm China Growth Capital, referring to capital markets reforms in China. “In the past, start-ups were afraid of going public on Shanghai’s main board because they would be dwarfed by state-owned enterprises and have to go through a long, complicated IPO approval process. The Star Market is quickly maturing from a baby to a mature market – the Ant IPO is a major milestone deal.”

The Star Market’s earnestness also sharpens the kind of competition that spurred Hong Kong’s market operator and regulator to make their most consequential changes in listing regulations in 2018, amendments that opened the floodgates for technology start-ups, pharmaceutical research teams and secondary listings to take place in the city.

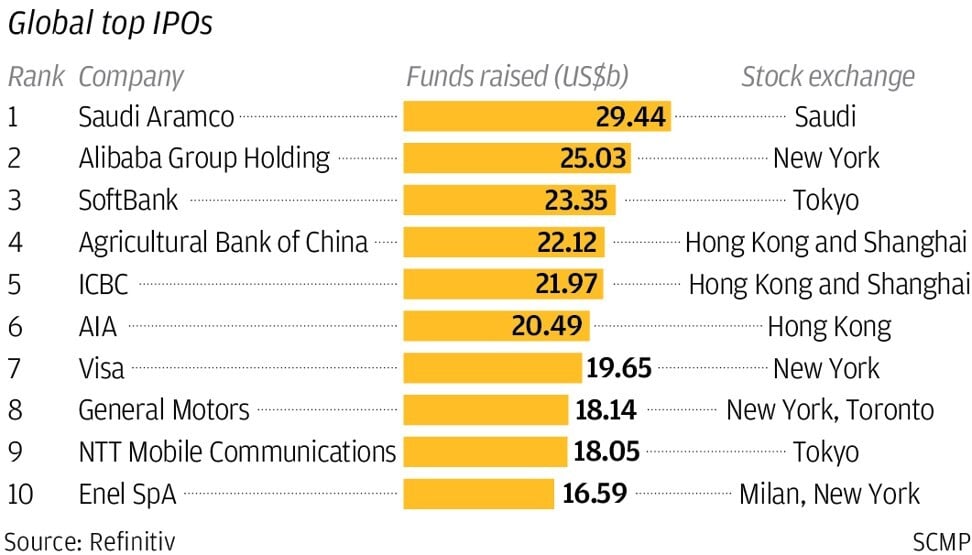

Ant filed its IPO papers on August 25 with Shanghai’s exchange, formally kicking off the regulatory approval process for what is likely to be the largest fundraising in history. While the size of the IPO is still subject to market conditions, the dual listing in Shanghai and Hong Kong may surpass the US$29.4 billion IPO last December by Saudi Aramco, the current record holder for the world’s largest fundraising.

Today’s approval marks one of the fastest by the Shanghai exchange of an IPO, underscoring China’s eagerness to support its national champions as it competes with the US for technological supremacy. Rivalry between the two superpowers ranges across trade, intellectual property and national security.

Shanghai is also battling fiercely with other exchanges globally to attract fast-growing technology companies and is keen to pave the way for Ant’s IPO, which is likely to set a record for the world’s largest capital raising this year, maybe ever.

The Star Market, formally known as the Science and Technology Innovation Board, adopted a registration-based IPO process when it launched last year after an edict by Chinese President Xi Jinping eight months earlier. It’s a more straightforward and shorter procedure than used elsewhere in mainland China’s capital markets.

The current record holder for the fastest approval is the chip maker Semiconductor Manufacturing International Corp. (SMIC), which won its go-ahead

from regulators in just 18 days, and listed its shares on Star Market in 45 days. SMIC, whose shares also trade in Hong Kong, delisted its American depositary receipts in New York amid concerns of potential forced expulsions of Chinese companies from Wall Street amid escalating US-China rivalry.

Foxconn Industrial Internet, a unit of the world’s largest contract manufacturer of electronics, took five weeks to get the nod to raise 27 billion yuan in Shanghai, in a regulatory process that used to take as long as three years.

“The IPO market also opened very quickly, so we encouraged our portfolio companies to raise more money and get into the process of IPO,” said Richard Li, managing director and CIO of Legend Capital at a conference this week.

To be sure, Ant did not get a free pass from the listing committee in Shanghai. It was grilled during the meeting on areas such as its relationship with major shareholder Alibaba Group Holding, protection of minority shareholders and its planned use of IPO proceeds, according to the filing

in Shanghai on Friday. Alibaba, the South China Morning Post’s parent, owns a third of Ant’s stock.

This is not the first time that regulators in Shanghai have pressed Ant about its ownership structure. On August 30, the exchange raised 21 questions about Ant’s listing application, including one about its independence from Alibaba. Ant replied on September 7 that its actual controlling shareholder is Chinese billionaire Jack Ma.

Also not every listing applicant gets onto the fast track, whether it is the Star Market, or the ChiNext market for growth companies in Shenzhen. The average queue still takes several months, although a vast improvement from the two-to-three year wait, involving at least 12 months of coaching by an appointed investment bank or qualified underwriter, for companies involved in more traditional businesses.

Ant will gauge demand for the stock before setting a price range for the offering. At that point, institutional and retail investors will be able to subscribe to the shares. Only after that will the stock trade on the two exchanges.

Fast-track approvals are just one aspect of a broad-based effort by Beijing to make its capital markets more investor-friendly and attractive to start-ups.

The Star Market has also removed an implicit valuation cap of 23 times earnings for new listings previously standard in China’s domestic markets.