Hong Kong News

Alibaba is at the center of a huge Hong Kong-Wall Street realignment

Less than a decade later, Alibaba’s calculus has changed. On Monday, the company announced that it will pursue a primary listing on the Hong Kong Stock Exchange (HKEX), as the 2024 deadline for U.S.-listed Chinese firms to comply with U.S. audit rules inches closer. Washington and Beijing are negotiating rules that would allow American officials to inspect the books and auditors of Chinese companies that are publicly listed in the U.S., but the two sides have been unable to strike an agreement.

Discussions have hit an impasse because Beijing wants to redact sensitive information in Chinese firms’ audit papers over national security concerns, but the U.S. is demanding full access, according to Bloomberg. Should the U.S. and China fail to ink a deal, 261 U.S.-listed Chinese firms worth $1.3 trillion could be booted from American stock exchanges.

The primary—rather than secondary—listing in Hong Kong of one of China’s most vaunted tech firms will strengthen the Asian bourse’s role as Wall Street’s replacement for Chinese securities listed in the U.S. Alibaba’s move also provides a blueprint for its peers—offering a viable back-up plan that allows direct access to a new pool of mainland China investors in case of a U.S. delisting and global investor retreat. And, experts say, it could be the catalyst that sparks a wave of Chinese tech giants flocking to the city for a primary listing, which could result in billions of inflows for one of Asia’s top stock exchanges.

Hong Kong hedge

For Chinese firms, Hong Kong’s sophisticated capital market and closeness to mainland China makes it the most attractive Wall Street alternative in the event of a mass U.S. delisting of Chinese stocks. The loss of China-based companies from New York would make it more difficult for Americans to invest in Chinese companies. U.S. institutional investors alone hold $200 billion of exposure to Chinese American Depository Receipts (ADRs), a specific security that lets U.S. investors purchase shares in foreign firms.

Over the last few years, Chinese companies have pursued secondary listings—also known as ‘homecoming listings’—in Hong Kong to hedge against the U.S. delisting risk. Secondary listings are easier, quicker, and cheaper to complete than primary listings.

Alibaba will convert its secondary listing into a dual primary listing in New York and Hong Kong. With the 2024 delisting deadline looming closer, and Washington and Beijing seemingly no closer to reaching an agreement, this strategy made the most sense for Alibaba given that it’s at a high risk for a U.S. delisting, Liqian Ren, director of ModernAlpha at Wisdom Tree Asset Management, told Fortune.

China is angling for a compromise that would see U.S.-listed Chinese firms divided into three categories: those that hold non-sensitive, sensitive and secret data, according to an FT report. Beijing would likely allow those in the first category to open their books to American regulators. But companies holding what Beijing deems as sensitive and secret data would be required to delist from the U.S., as it wants to prevent foreign authorities from accessing such information.

China recently enacted new data security and personal information protection laws, which gives its authorities more control over private companies’ data in the name of national security. Alibaba, an e-commerce and cloud provider with over 1 billion users, would most likely be classified as a company holding information that Beijing wants to keep within its borders. “Every feature of Alibaba points to the fact that its time in the U.S. could soon be over,” Ren says.

Alibaba’s pivot “will prove a catalyst” for its peers to follow suit, Adam Montanaro, investment director of global emerging markets equities at abrdn, told Fortune. Hong Kong should “expect a flurry” of U.S.-listed Chinese firms seeking a primary Hong Kong listing, Travis Lundy, analyst at Quiddity Advisors, an investment advisory firm, wrote in a Monday note.

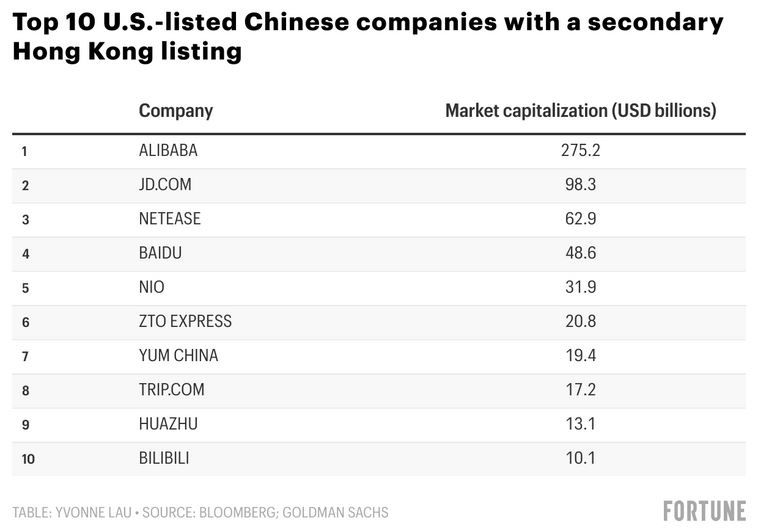

Chinese giants like Alibaba rival JD.com, internet and artificial intelligence (A.I.) giant Baidu, and gaming firm NetEase, are highly likely to go this route, Brian Freitas, analyst at Periscope Analytics, said in a Monday report. The larger U.S.-listed Chinese stocks, around 80 to 100 of them, will be eligible for a primary listing, Lundy estimates. Such firms “fit the bill” to be delisted from the U.S. as major internet platforms with millions of users and troves of data, Ren notes.

SoftBank-backed e-commerce firm Dingdong has begun preparing for a dual primary listing in Hong Kong, according to a recent Reuters report. In May, video platform Bilibili said that it had applied for a HKEX dual primary listing and aims to finalize the deal in October. “The writing is on the wall for these companies,” Ren says.

Tapping the mainland pipeline

And a primary listing on the HKEX offered one critical advantage for Chinese companies: direct access to mainland investors.

Primary listed stocks in Hong Kong are eligible for inclusion in the Stock Connect, a system linking the Hong Kong, Shanghai, and Shenzhen exchanges. Mainland individual and institutional investors can therefore directly invest in these firms.

Wealth management firm Bernstein predicts that Alibaba’s inclusion in Stock Connect could translate to $21 billion in investor inflows to its Hong Kong-listed shares. The company’s 3-month average daily trading volume in Hong Kong would likely rise from the current $700 million closer to its New York volume of $2.6 billion, Brendan Ahern, chief investment officer at Krane Funds Advisors, a China-focused investment management firm, told Fortune. He points to Alibaba rival Tencent as a case study. Chinese investors, via the Stock Connect, currently hold 7% of Tencent stock valued at $29 billion. Alibaba would see a “significant inflow… assuming a similar amount” of Chinese investor funds are channelled into Alibaba’s Hong Kong share class, he says.

Chinese investors will flock to these stocks, experts say. A recent rally by China’s tech stocks will attract mainland investors “who believe the worst” has passed, John Lau, head of Asian Equities at financial services firm SEI Investments, told Fortune. Mainland investors are also searching for ways to diversify their portfolios, given China’s real estate crisis and the government’s cryptocurrencies crackdown, Ren says.

Goldman Sachs predicts that investors could provide Hong Kong with $30 billion of inflows should Alibaba and 14 other Chinese firms convert their secondary listings to primary listings in Hong Kong.